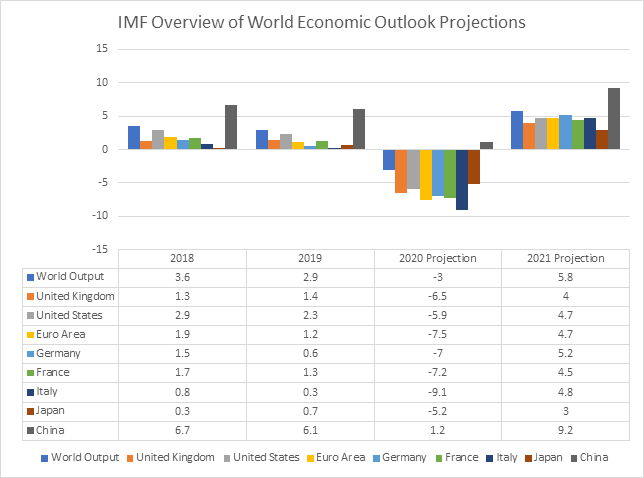

The International Monetary Fund (IMF) has published its latest World Economic Outlook April 2020, taking into account the likelihood of a sharp downturn in Global Growth for 2020.

The table below shows the outlook from some of the major economies in the world.

Table: Overview of the World Economic Outlook Projections

In most cases, growth had slowed from 2018 to 2019; however, the IMF, although indicating a slowdown in their April 2019 Outlook Report was still anticipating World Output in the region of 3 per cent in 2020.

Clearly, at the time of the April 2019 Report, nobody had expected Covid-19 and what it would do to the global economy.

My point of view was similar to the IMF in that a slowdown was on the cards, but I remained positive for 2020 with a potential downturn in 2021 after the US Presidential Election.

Why so positive for 2020?

The US Presidential Elections and the likely Brexit bounce in the UK followed by the realisation that global output would potentially contract in 2021 with most western economies entering some form of recession in 2021.

I was then anticipating markets to start falling in the last quarter of 2020 and a negative year on major stock markets in 2021 with a pick up in sentiment in 2022, reaching possible highs again in 2023.

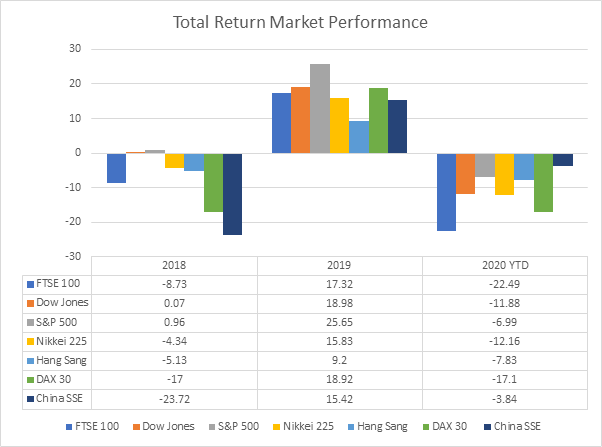

Overview of Stock Market Performance

Total Return: Includes dividend income

Global stock markets were still riding high in January 2020, and the Coronavirus had started to take its toll in China. However, although stock markets did fall in the region by about 10 per cent, they began to recover again in February.

The thought process was western markets could also get caught up with negative sentiment but potentially similar to China.

However, the speed of the outbreak in Europe and lockdowns in place too late sent markets tumbling, and the FTSE 100 index was down by 34 per cent from the beginning of the year to 23 March 2020.

The table above shows, European markets have dropped more than in the US and the Asia Pacific Region but have had more Government bailouts.

Government bailouts have helped markets to recover, but the on-going recovery can only be sustained if countries start to move from lockdown into typical consumption by the last quarter of 2020.

Can we rely on the figures published by the IMF

Starting with the positives and the IMF outlook being that consumption will drive up growth next year once countries return to the norm.

If lockdowns begin to be relaxed by the end of June and world economies, start to recover, then it is highly likely that GDP figures will be accurate with stock markets potentially already hit bottom.

However, if the current conditions continue beyond the end of June, I can only see global stock markets dropping and sentiment deteriorating beyond 2020.

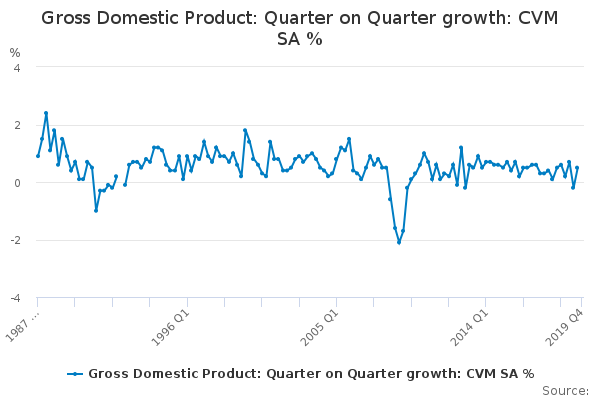

The Office for Budget Responsibility (OBR) indicated yesterday that UK GDP in the second quarter of 2020 could fall by 35 per cent and unemployment could reach 2 million or 10 per cent of the working population.

If the OBR prediction is correct, it will be the worst quarterly performance of GDP on record and more than double the previous forecast of between 15 to 18 per cent.

Therefore the coming months are going to be essential with China releasing first-quarter GDP figures shortly with indications being the economy will contract by 6.50 per cent the first quarterly fall since 1992.

You can read the full IMF World Economic Outlook, April 2020 by clicking the on the link and you can keep up to date by viewing my Live Updates: News & Markets on the website.