Explaining why markets have crashed over the last couple of weeks is easy, but trying to work out how global stock markets will react in the next few months is not going to be as simple.

We can certainly look back at previous market falls including Black Monday, The Dot-com Bubble, 911 and the Credit Crunch in 2008. However, I think the Coronavirus is something completely different and is going to be hard to call.

Therefore, I will take a brief look at some of the most recent market falls and try and look to any similarities which may give us an indication of how markets will react to the Coronavirus epidemic.

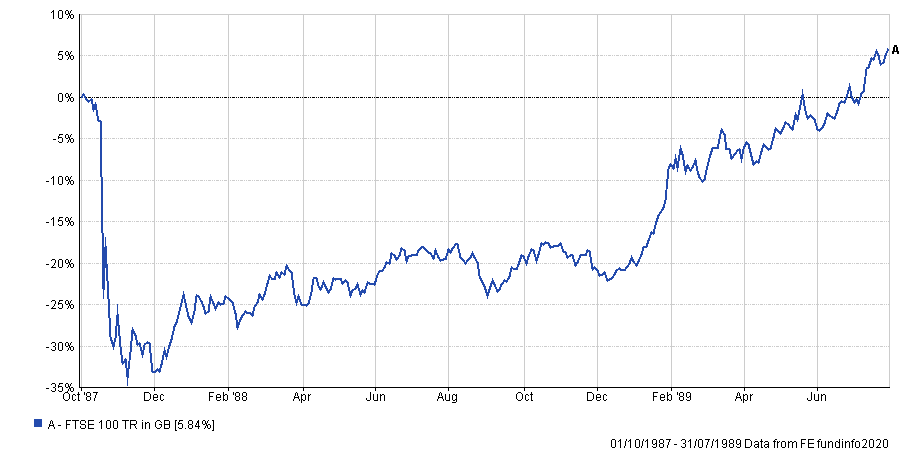

Black Monday, October 1987

Looking back at Black Monday in 1987, explaining the initial fall in global stock markets is easy.

A computer system selling stocks and the possibility of a recession triggered a 22 per cent fall on the Dow Jones on Monday 19 October 1987.

The FTSE 100 index fell 11 per cent on the day, and although a recession didn’t start until the early 1990s, the index didn’t recover until the third quarter of 1989 two years later.

Dot.com Bubble and 911

The origins of the Dot.com bubble can be traced back to 1995, which was the start of a bull market.

Loss-making internet companies become the new fashion in the US with the Nasdaq Composite surging 400 per cent in five years.

In the UK lastminute.com floated in March 2000 at 245 pence but within two weeks the share price had dropped on the back of Boo.com going bust.

The FTSE 100 started to drop, and the 911 attacks in September 2001 compounded this as the graph above highlights the full extent of the drop after a rally in 2002. However, it took three years to get from the peak to the trough.

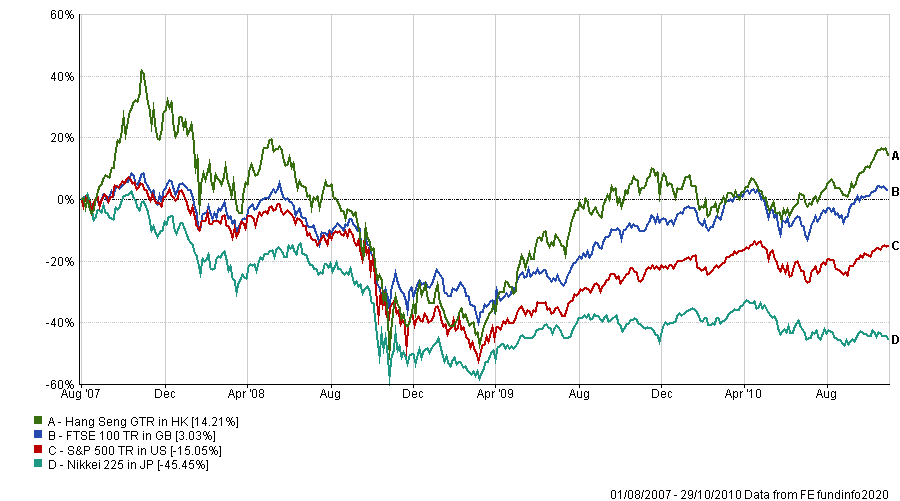

Credit Crunch

The Credit Crunch, in the end, turned out to be a global banking problem with the intervention of governments to prop up the banking system.

Although it was the summer/autumn of 2008 when the crisis hit the origins in the UK dated back to September 2007 when the UK bank Northern Rock had liquidity problems.

The FTSE 100 index hit 6,730 in October 2007 when Northern Rock was having problems, and it didn’t hit the bottom of 3,530 until March 2009, nearly eighteen months later.

Similar to the Dot.com and 911 market crash, it was a three year period from the peak to the trough.

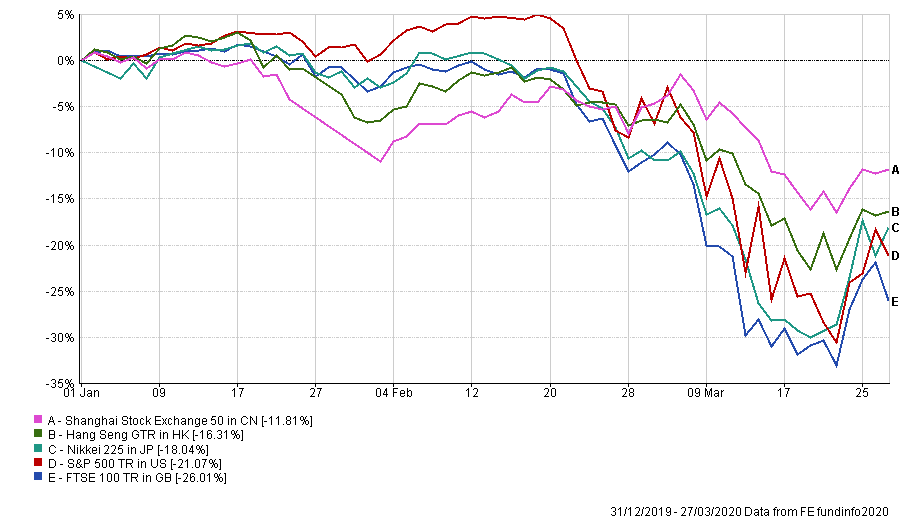

Coronavirus 2020

The Coronavirus pandemic started in Wuhan China at the end of 2019, but it didn’t escalate until mid-January in the region. As you can see from the above graph, both the Shanghai and Hong Kong indexes both dropped about 10 per cent but regained some of the losses in the next two week period.

By the end of February, the virus had spread to Europe and western stocks markets took fright and started to drop more than Asian markets the previous month.

The FTSE 100 dropped 33 per cent from the beginning of the year to below 5,000 points on 21st March 2020. However, unprecedented recent measures put in place by the UK and other western governments may stabilise markets.

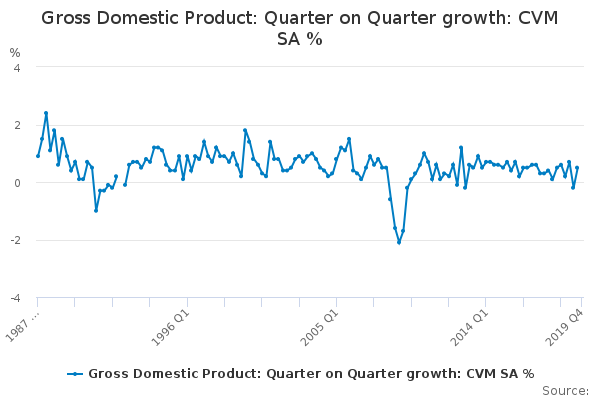

The first indication of how economies will be affected came from Singapore with a GDP contraction of 10.60 per cent in the first quarter of 2020. Other Asian economies will likely follow when figures in the coming weeks are published.

However, western economies are potentially going to feel the pain in the second quarter of 2020, with estimates that the UK GDP figure to be in the region of a 15 per cent contraction.

A global recession is inevitable, but one not seen before with governments stimulus packages aimed at saving jobs and businesses.

What’s Going to Happen to Markets in 2020?

That is a good question and hard to answer, but I will give you my opinion, which may not be correct, but the previous crashes might provide an indication.

Both the Dot.com/911 and Credit Crunch crashes had indicators several months and possibly a year before actual markets started to fall. In both cases, the peak to the trough was approximately three years, taking eighteen months to reach the bottom before picking up.

The impact of 911 didn’t help the Dot.com crash, and the Credit Crunch was a banking issue caused by years of light-touch regulation by western governments.

Where the Credit Crunch leads to a recession, the Dot.com/911 crash didn’t as it was seen more as an over-priced market and then airlines and tourism taking a hit after 911.

My viewpoint is that the current market conditions are similar to Black Monday, all be it with different circumstances causing market falls.

If you have had a review or spoke to me recently, my opinion was that a recession was on the cards for 2021 and my thought process would be the long term effect being similar to the Dot.com/911 and Credit Crunch to markets, i.e. a peak to a trough of three years.

So why do I think markets might follow the same path as 1987?

Over the last month, the severe drop does mirror Black Monday by way of how the FTSE 100 has followed a similar path.

Back in 1987 the FTSE 100 dipped 34 per cent from 1 October to 9 November 1987 and remained at that level until the end of November before recovering over the next two years.

From the peak on 17 January to 23 March 2020 the FTSE 100 index dropped 34 per cent to a low of 4993 points.

Not wishing to seem too optimistic my feeling is that the bottom of the market may be the level reached on 23 March 2020. However, I remain cautious as the index could fall below that level to under 4,500 points if the current lockdown moves into the third quarter of the year.

The clear difference between the Credit Crunch and now is potentially after the current lockdown and restrictions lifted, consumption will thereby increase, and sentiment will improve.

There will be an increase in unemployment and businesses will fail, a global recession will happen, markets will go up as they always do, but I suspect the peak to the trough will be quicker than anticipated.