Last year the government revealed new proposals for funding long-term care.

At the time, much was made of the point at which someone needing to pay their care costs in full increasing to £100,000 and the overall cap on care costs being £86,000. The Government made out as if this fulfilled its manifesto promise that “Nobody needing care should be forced to sell their home to pay for it”.

However, the new cap is not all it might seem and some still might have to sell their homes to pay for care.

How do the new rules work?

I will cover the English rules and keep things relatively simple.

Any income someone who is in long term care receives in excess of £24.90 pw must go towards paying for their care costs. This includes pension income, rental income, and investment income. If someone cannot meet the costs of care through their income, then they may have to use their assets to pay for it. If these assets, including savings, investments, and property, exceed £14,250, the expectation is that they would have to go towards some of the cost. Should they exceed £23,250, they must go towards all of the cost.

From 2023 the new rules will be that these amounts would increase to £20,000 and £100,000, respectively. So, someone will have to pay for some of their care if they have assets worth between £20,000 and £100,000 and all of it if there are worth more than £100,000.

What about the cap on costs?

The big change with the new rules is the cap on the costs someone would have to pay of £86,000. However, there is more to this. the cap is not all it seems. The cap only covers the cost of care which the relevant Local Authority would define. It does not cover living costs such as accommodation. It also does not cover the costs of higher standards of care.

Let’s use an example of someone with total care costs of £1,200 per week, of which the Local Authority would be willing to pay £600. They might assess that of this, £400 is the care cost element and £200 is the daily living cost element. If assets exceed £100,000, they will need to be used to fund the cost of care. Because only the care cost goes towards the cap, more than £86,000 will need to be spent to hit it. Assuming costs stay level, overall costs would need to be £258,000 in this example before the cap applies.

This means many will use up a lot more of their assets than they might think.

What can I do?

As you enter retirement, thinking about long term care should be a priority. Planning ahead is always the best approach.

A key thing to have in place is a Lasting Powers of Attorney (LPA). This means you get to choose who you would like to make decisions about your health and welfare.

Other options to protect your assets include gifting assets and investing in certain ways. All come with pros and cons, so advice is key.

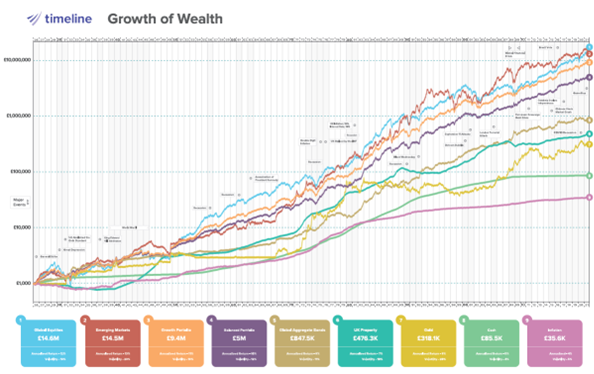

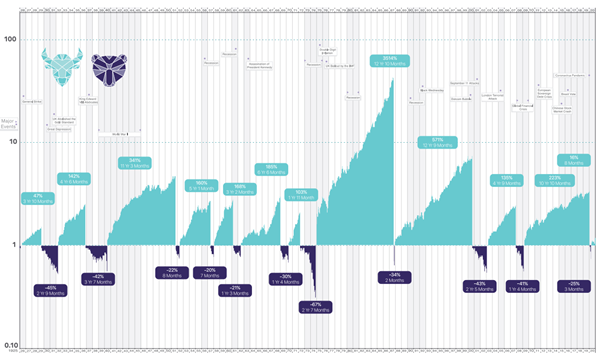

Long term care can be a threat to the wealth you have built up during your lifetime. This is why we spend so much time reviewing this for our clients.