It Will Be Romantic

A few years back Mrs R and I (though more Mrs R, if truth be told) thought it would be an excellent idea to buy a house that needed a little work. By little, I mean, lots. Mrs R, having watched a few episodes of Grand Designs proclaimed, “it’s only two weeks’ work, it will be romantic”. Suffice to say, we’re still not finished. Throw in some comical events, like Mrs R’s foot popping through the newly plastered ceiling and the odd rogue trader and we’re 90% there. But if the “hell house” as our home is now affectionately called has taught us anything, it’s the importance of perseverance.

Perseverance is something that investors have needed in abundance, realistically since early 2020. Investors have been under siege from headwind after headwind. First, the pandemic and national lockdowns saw the global economy grind to a halt, which unsurprisingly threw markets into their sharpest decline since the 1930s. When lockdowns ended and economies began to reopen, a quick return to normality was hampered by supply chain issues which contributed to rising inflation. Finally, as 2022 began, Russia invaded Ukraine. Markets unsurprisingly dropped but soon bounced back. The subsequent response from the West has been more challenging for investors as sanctions, particularly on Russian energy products, contributed to levels of inflation across the globe not seen for decades.

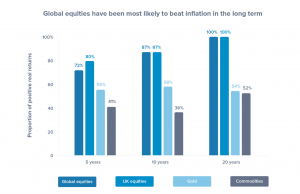

It’s actually during periods such as these, that disciplined investors are rewarded over the long term for persevering during the short-term. Undisciplined investors will lose their nerve, sell out and hold cash until markets start to recover. This is quite possibly the worst course of action. Selling low and buying high is not a sound investment strategy and holding cash will only result in the investor’s real wealth being eroded by inflation.

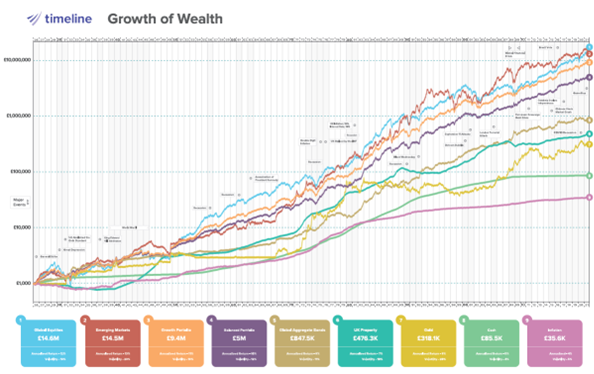

What should an investor do? The first thing is to take a step back and review the long-term picture. Two years is a short amount of time in financial markets. Stepping back and reviewing the data should provide some reassurance that what seems like normality now, really isn’t. If we look at market data from 1926 to 2021 it’s clear that the trend is forever upwards. The following chart shows that, despite numerous market disruptions, ranging from world wars to deep recessions, markets have historically, always recovered and reached even greater heights.

Source: Vanguard (2021)