Some are lucky enough to be awarded shares in the company they work for.

Companies can reward their staff with actual shares or options that they can exercise sometime in the future.

What is the difference between shares and options?

Shares and options have different uses and benefits. These include how they are taxed. It is useful to understand both.

With shares, a company may issue one of two types. These are ordinary shares and growth shares. Ordinary shares are the same as those that you can buy on the stock market. Growth shares are similar but come with a “hurdle price”. This means they are valued at a higher level than the ordinary share. As the price does not go up until the value of the ordinary shares reaches that elevated price, a shareholder will only get a portion of any growth in the value of the company.

Stock options give you the right to buy a certain number of shares in the company at a specific price. This right might expire after a certain amount of time, especially if the person with the right leaves the company. Options themselves don’t offer the same benefits as being a shareholder such as dividends and voting rights.

I have heard about “vesting” and “cliffs” with options. What are they?

Vesting is how you get full legal rights to something. Typically, those who are awarded options get the right to access the shares step by step over time.

These schedules may include a “cliff” where you must have held the options, or worked for the company, for a certain time before you can access them.

Exercising options may incur costs and/or a tax liability. It is usually a good idea to get some advice from an accountant before doing so.

How can you help?

It is important to have a plan in place if you have to decide about a shareholding. There might not be a point in just selling your shares or options for the sake of it. It is crucial to have a well thought out plan.

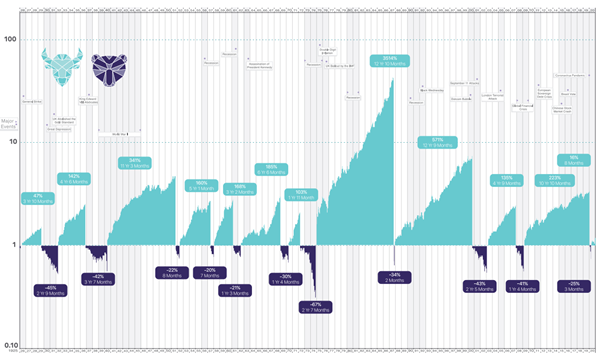

Another factor is that some might not believe the company they work for could ever do badly. Experience and history show us that having all your eggs in one basket is never a sound investment strategy.

Part of our job is to help you take the emotion out of the decision.

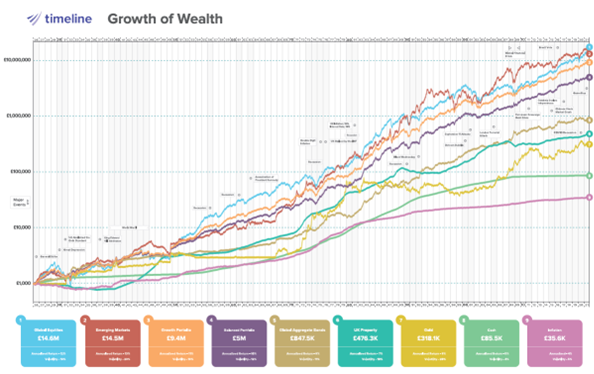

Even if there are no immediate plans to spend the money, reinvesting the cash in a robust portfolio may be a wise move.

We do not provide advice in relation to individual shareholdings (we would not offer an opinion on the future growth prospects of a company, for example).