We all wish we could outwit the financial markets. Instead of trusting them to produce life-changing returns, we fool ourselves into believing that we can predict when the market will fall and then rise again.

No one is immune to this temptation, but we can cure ourselves of the desire to act on it. With a better grasp of markets and how they work, anyone can begin to understand the best way to invest.

An efficient design

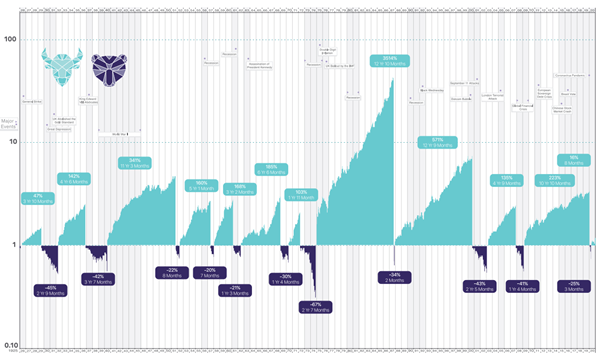

Millions of buyers and sellers continuously determine the price of trillions of dollars of assets based on publicly available information. While the countless trades that occur daily in global investment markets usually produce asset values that are close to their actual long-term value, we know the irrationality of crowds can cause significant swings in the prices of investment assets.

While it may seem obvious at times how prices might swing, we do not believe anyone can forecast when it will turn. Far too many have ruined their financial prospects by becoming short-term speculators when investing for the long term would have been more prudent. John Maynard Keynes famously observed, “The markets may remain crazy longer than you can be solvent”. As guardians of our clients’ hard-earned wealth, we must be humble investors in global financial markets.

Three reasons why we never time markets

Nobody can

As previously stated, markets move in ways that we cannot predict. Looking for information that may reveal a turning point is a pointless exercise; the market is forward-looking and can turn far before it’s evident that something is about to happen.

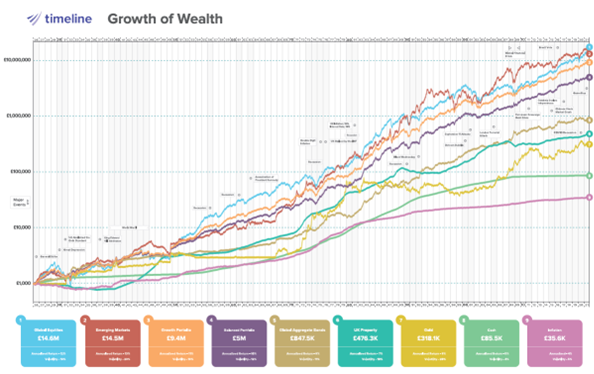

You don’t have to

We know from history that markets appropriately reward those who invest with patience and discipline. Why put your wealth at risk on the slim chance you might be able to outwit millions of other traders? We boost our chances of being correct in the long run by avoiding getting things wrong in the short term.

It is a distraction

Speculation invariably causes investors to think in days, weeks, and months rather than decades. We concentrate on the long term, content that what occurs this month is irrelevant. Short-term price swings will always happen, and we embrace this in exchange for higher long-term returns.

The honest approach

It is an unfortunate truth that, in the financial services industry, complexity and sophistication sell. While we would never attempt to time the markets with our client’s wealth, many “experts” profess to be successful at it. We embrace the simple approach, recognizing that if we consistently tell our clients the truth, their chances of long-term investment success rise.