If you want to invest, a top priority is determining how much risk to take.

Risk might sound scary, especially if you’re not a risk-taker elsewhere. More risk can mean higher returns when investing, but nothing is guaranteed.

Is having too much in equities a bad idea?

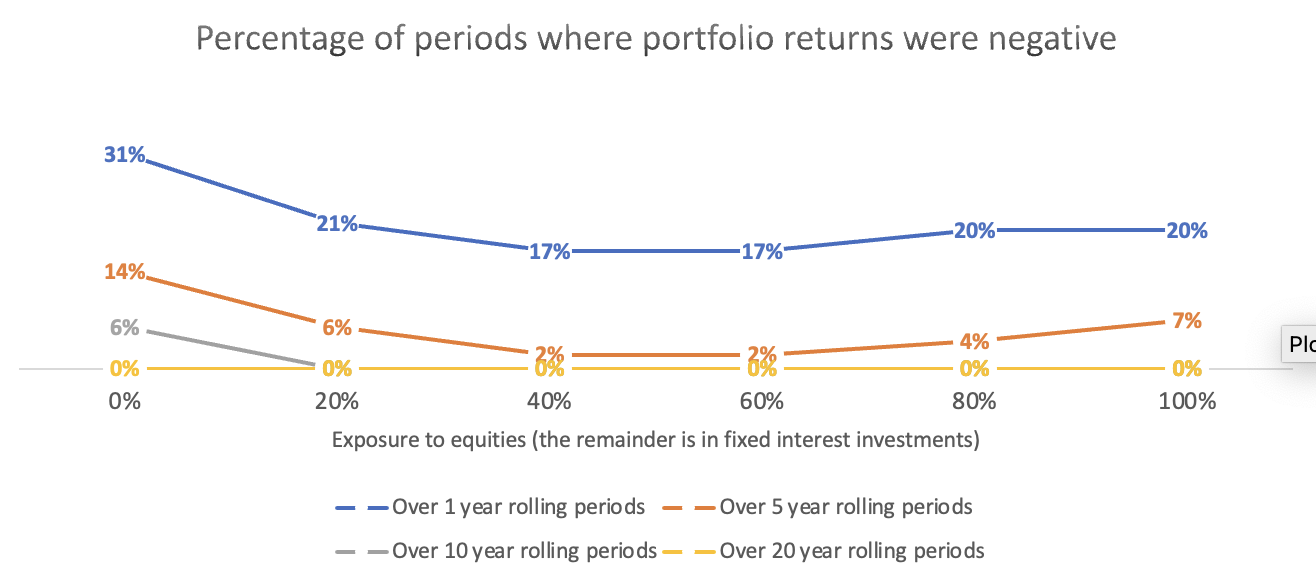

The chart below looks at the probability of losing money over various periods depending on how much the portfolio holds in stocks & shares (equities), and bonds. The numbers are based on 107 years of investment returns. The further across the horizontal axis, the more the portfolio holds in equities, and the less it has in bonds. The higher the vertical axis, the higher the number of historical periods where returns were negative.

Whilst past performance is no guarantee of future returns, it can provide us with valuable information.

Data from Timeline where equities are primarily held in global equity-based index funds and the fixed interest is held in a mix of UK Government bonds, UK Corporate bonds and Global bonds. Returns are net of 1.5% pa costs.

From this chart, we can make the following conclusions:

-

Portfolios holding a balanced mix of global equities and bonds have historically offered the best chance of not losing money over one and five-year periods.

-

Over ten- and twenty-year periods, if the portfolio has had a meaningful amount in equities, it has historically never lost money.

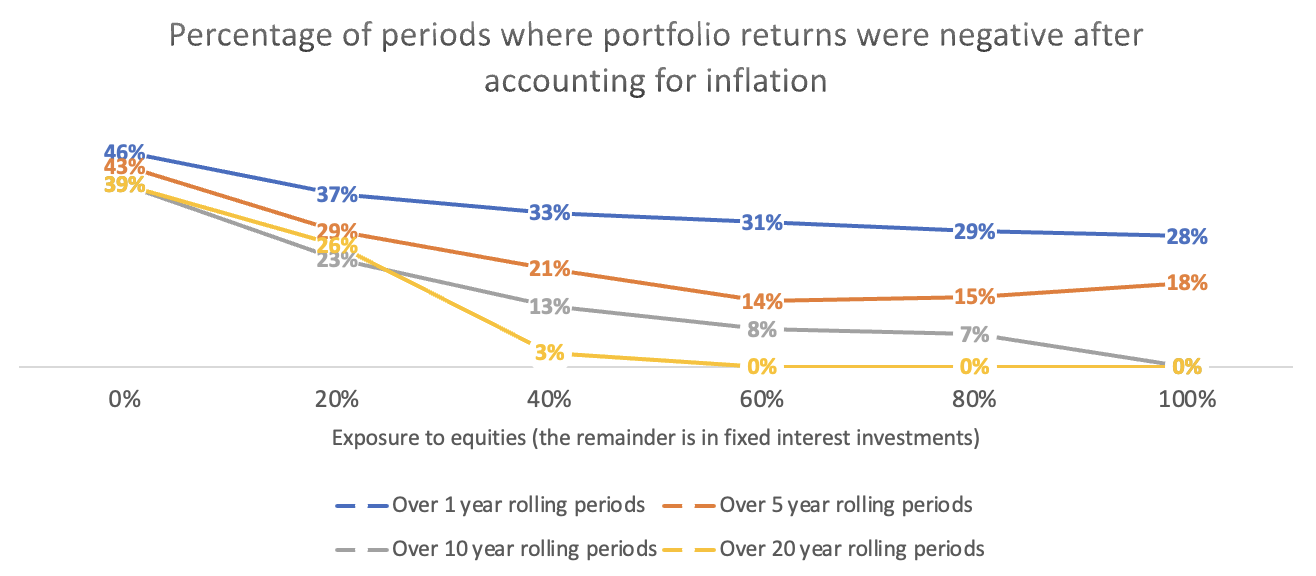

We have repeated the same process below but included the effect of historical inflation rates alongside investment returns.

Data from Timeline where equities are primarily held in global equity-based index funds and the fixed interest is held in a mix of UK Government bonds, UK Corporate bonds and Global bonds. Returns are net of 1.5% pa costs.

From this chart, we can make the following conclusions:

-

Portfolios holding a balanced mix of global equities and bonds have historically offered the best chance of achieving positive returns after inflation over five years.

-

Over ten- or twenty-year periods, a portfolio has needed a significant weighting to equities to outperform inflation.

-

This is the same over one year.

Global equity returns can be somewhat stable when viewed over the long term. Over the long term, they have generally outpaced inflation, although this is not guaranteed. However, the differences in returns can be dramatic over the short term. The worst the 100% equity portfolio we used in our analysis performed over one year was -38% after inflation. But over 20 years, this portfolio’s worst returns were still 3.75% pa after inflation (109% overall). There are certainly better and worse times to get into the market, but over the long term, positive and negative events average out each other.

Historically, returns of bonds are much lower and tend to underperform inflation. When viewed over 20-year periods, the 100% bond version of the portfolio underperformed inflation just over a third of the time. The worst of these produced an annual loss of -1.75% pa after inflation (-32% overall).

So why would I hold bonds in my portfolio?

One of our fundamental beliefs is that the portfolio that an investor can hold for the long term is the best one for them. If long-term investors could stick to whatever portfolio is right for them no matter what, investing their money into equities would rarely be unwise. However, we all live in the present and are subject to varying degrees of anxiety. One year is investors’ typical evaluation horizon only in calm times. In times of stress, we tend to view returns over much shorter periods. A portfolio not being suitable can potentially result in the following in an investor:

-

Becoming too cautious, such as selling everything and holding it in cash or.

-

Indulging in speculative actions such as trying to time the markets.

Both can result in worse long-term returns in a portfolio which exhibits short-term fluctuations in value that we can cope with.

Over 1-year periods, a balanced mix of bonds and equities gave the best chance of positive returns. Over five years, it has been the same case even after inflation. This is because bonds tend to rise when equities fall and vice versa. Another is that poor years for equities bonds tend to be worse than poor years for bonds.

Holders of balanced portfolios trade reduced long-term returns for short-term emotional comfort. For many, this is a price worth paying.

How could financial advice help?

Everyone is willing to take a certain amount of risk. When looking at this, we need to be aware of the difference between:

-

Risk tolerance: an investor’s stable, reasoned willingness to take risks in the long term, and

-

Behavioural risk attitudes: the unstable, short-term desire to take risks exhibited through our actions.

When assessing the amount of risk someone is willing to take, risk tolerance reflects the level of risk someone should be comfortable with over the long term. In contrast, behavioural risk attitudes frequently reflect temporary and irrational preferences. How composed we are during turbulent times significantly affects our returns.

Financial advice can help investors understand their long-term willingness to take risks. More importantly, it can help them stay invested and not become too irrational. It can do this by being a critical friend when turbulent times present investors with the desire to “do something”. Having a robust financial plan in place which is aligned with meaningful goals is also critical in keeping the focus on the long term.